The Benefits of Secured Loans: What You Need to Know

In the ever-changing world of finance, navigating loan options can feel overwhelming. But if you're looking for a loan with clear benefits and a sense of security, then a secured loan might be the perfect fit for you.

What is a Secured Loan?

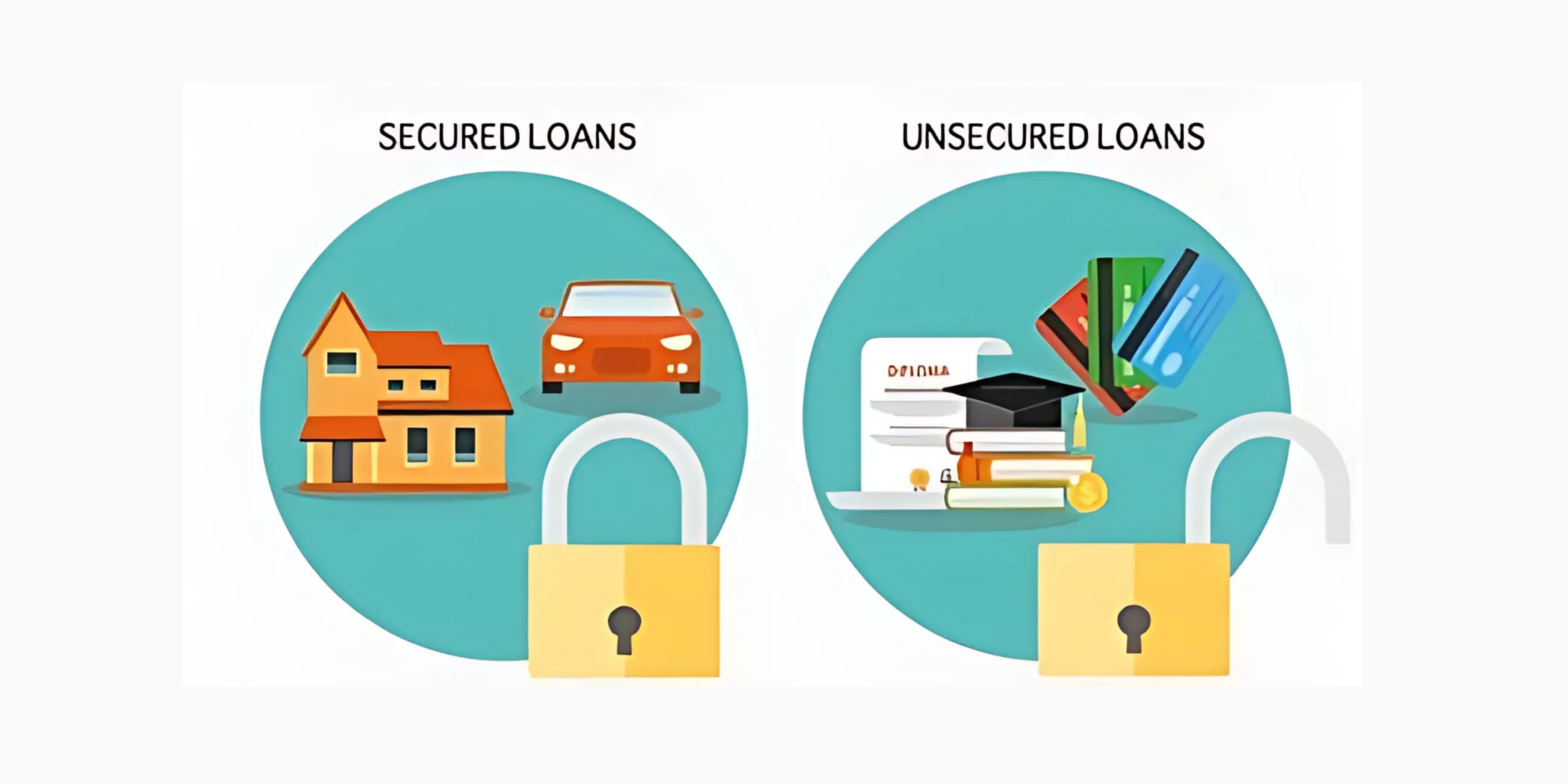

A secured loan uses an asset, like a car or property, as collateral. This means that if you fail to repay the loan, the lender can repossess the asset to recoup their losses.

Why Choose a Secured Loan?

Secured loans offer a variety of advantages over unsecured loans:

- Lower Interest Rates: Due to the reduced risk for the lender, secured loans typically come with lower interest rates compared to unsecured loans. This can translate to significant savings over the life of the loan.

- Higher Loan Amounts: Because the lender has collateral to fall back on, they're often more comfortable offering higher loan amounts with secured loans. This can be helpful for larger purchases like a car or a home renovation.

- Improved Credit Score: Making consistent and on-time payments on a secured loan can positively impact your credit score. This can open doors to better loan options and lower interest rates in the future.

- Peace of Mind: Knowing you have a valuable asset backing your loan can provide peace of mind. It can also serve as a motivator to stay on top of your repayments.

Types of Secured Loans

There are several types of secured loans available, each with its own specific uses:

- Mortgage Loans: Used to finance the purchase of a home.

- Auto Loans: Used to finance the purchase of a car.

- Home Equity Loans (HELOCs): Uses the equity in your home as collateral to access a line of credit.

- Title Loans: Uses your car title as collateral for a short-term loan.

Things to Consider with Secured Loans

- Risk of Repossession: If you default on the loan, you risk losing your collateral.

- Loan-to-Value Ratio (LTV): This ratio determines the maximum loan amount you can qualify for based on the value of your collateral.

- Prepayment Penalties: Some secured loans may come with prepayment penalties if you pay off the loan early.

Finding the Right Secured Loan

Before applying for a secured loan, it's important to shop around and compare rates and terms from different lenders. R Secured Finance, a reputable NBFC in Hyderabad, offers a variety of secured loan options to suit your business needs https://www.rsecuredfinance.com/. They specialize in secured loans and have a proven track record of helping businesses grow.

Secured loans can be a powerful financial tool, offering lower interest rates, higher loan amounts, and the potential to build your credit score. By understanding the benefits and considerations, you can make an informed decision about whether a secured loan is the right choice for you.